Back to Blog

Know more about MPF Constituent Funds – Mixed Assets Fund

Last time, we introduced the characteristics and risks of equity funds, and today we would like to share another common constituent fund - mixed asset funds. According to the MPFA, as of 31 March 2025, there were 161 mixed-asset funds in the MPF market, which is currently the largest approved constituent fund, accounting for 42% of the total 380 constituent funds in the market^.

^Source: Data from MPFA website

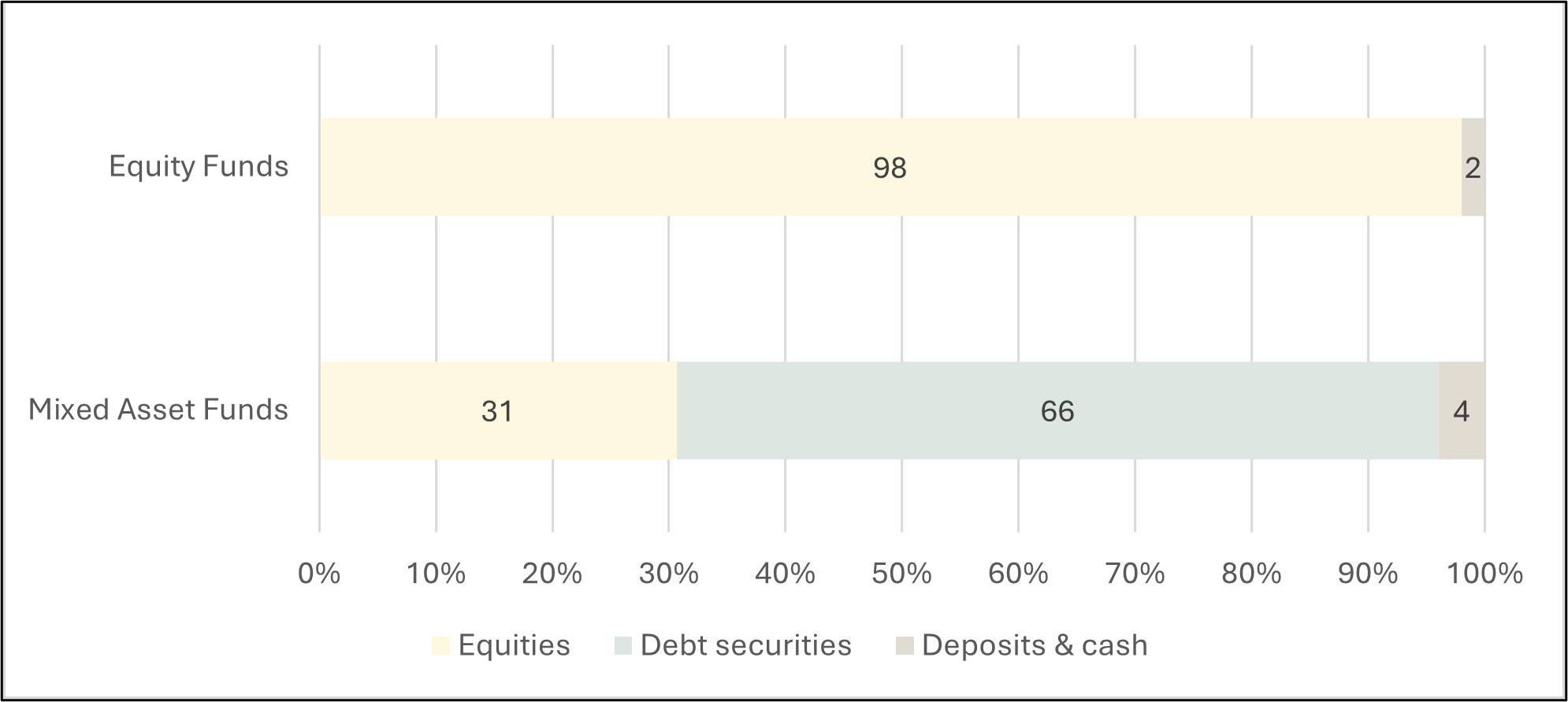

Mixed asset funds include more than one asset class, investing in global bond and stock markets to achieve risk diversification and long-term capital appreciation. According to the MPF Schemes Statistical Digest quarterly report published by the MPFA in December 2024, as of September 30, 2024, about 98% of equity funds in the market were invested in stocks, while mixed asset funds overall invested only about 66% in stocks, with another about 30% invested in bonds, and the remainder in deposits and cash, resulting in relatively lower risk. (See chart below)

Asset allocation of Mixed Asset Funds and Equity Funds*

(As of September 30, 2024)

*Source: Mandatory Provident Fund Schemes Statistical Digest (Quarterly Report) published by the MPFA in December 2024

Unlike equity funds which are typically named after regions, mixed asset funds have more "abstract" names. In the market, the fund names of mixed asset funds include "Balanced Fund," "Core Accumulation Fund," "Growth Fund," etc. It's difficult to assess the characteristics and risks of the fund based on the name alone. People should carefully read the sales documents or fund fact sheets or use MPF platforms to know more about the fund's stock-bond ratio, fees, risks, and performance. The platforms categorize mixed asset funds into 4 types based on their stock-bond ratios (81% to 100% stocks, 61% to 80% stocks, 41% to 60% stocks, and 21% to 40% stocks). There are also "Core Accumulation Funds," "Age 65 Plus Funds," and "Uncategorized Mixed Asset Funds."

The risk of mixed asset funds generally depends on the relative ratio of different assets in the portfolio; the higher the proportion invested in stocks, the higher the fund risk. The main risks include stock market volatility and individual stock performance, exchange rate fluctuations, interest rate volatility, and bond credit ratings.

In general, mixed asset funds have relatively lower risk compared to equity funds, yet their return performance remains impressive. According to the MPFA data as of the end of December 2024, since the implementation of the MPF system in late 2000, the average annualized net return of mixed asset funds has been 4%*, surpassing the inflation rate of 1.8% over the same period and slightly trailing equity funds at 4.3%. Scheme members can choose different combinations of equities and bonds based on their life stages. Typically, younger individuals, with a longer investment horizon and higher risk tolerance, may opt for portfolios with a higher equity component to pursue greater expected returns.

*Source: Mandatory Provident Fund Schemes Statistical Digest (Quarterly Report) published by the MPFA in December 2024

Disclaimer: The information, data, and documents provided on this website are for general reference purposes only and should be used as self-help tools. Investment involves risks, and unit prices may fluctuate. Past performance figures shown are not indicative of future performance. BestServe Financial Limited and its content providers are not responsible for any loss or damage caused by reliance on any information or advice made in this website.