Back to Blog

Beware of the Out-of-Market Period when transferring your MPF

For most employees, MPF contributions begin as soon as they enter the workforce and typically remain untouched until retirement at age 65, making it one of the longest-term investments in many people’s lives. Employees can manage their MPF more flexibly by consolidating or transferring their MPF accounts, allowing them to tailor their MPF investments to their personal needs.

However, like other investments, the MPF carries risks. Employees should treat the MPF as a long-term investment tool and avoid managing it with a short-term, speculative mindset. In particular, when transferring your MPF funds, they must be mindful of potential out-of-market period during the transition process.

Out-of-market period primarily refers to periods during the MPF investment process when, due to market fluctuations or fund transferring, an investor’s funds are temporarily out of the market. For example, when a member transfer MPF funds, there may be an “out-of-market period,” during which the original fund has been sold, but the new fund has not yet been purchased. During this time, market prices may fluctuate, potentially leading to a “sell low, buy high” scenario, which could negatively impact investment returns.

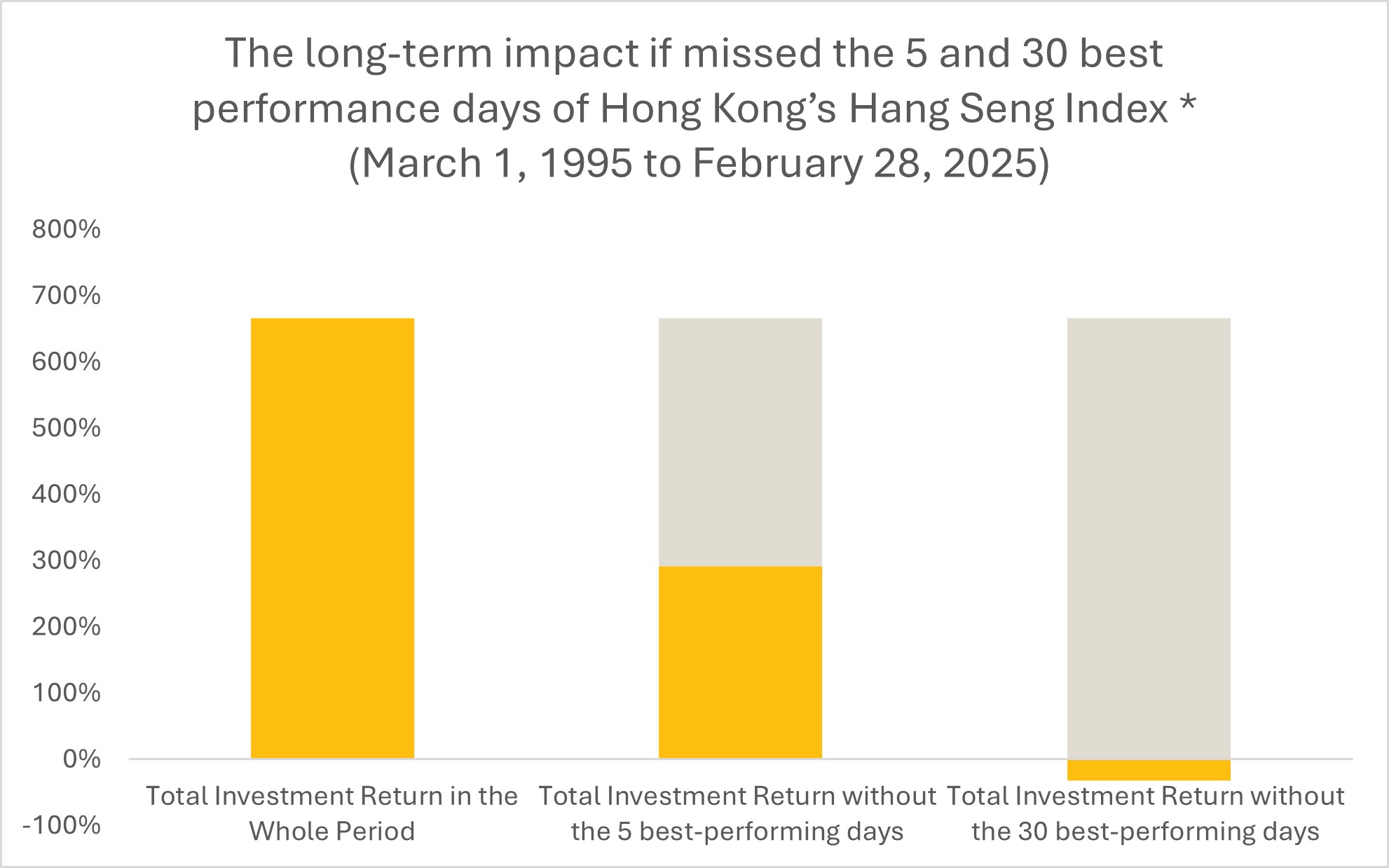

In fact, using the historical performance of Hong Kong’s Hang Seng Index as an example, from March 1995 to February 2025, the total investment return was 666%*. However, if an investor missed the 5 best-performing days of the Hang Seng Index during this period, the potential long-term return would drop significantly to just 292%, a reduction of more than half. Missing the 30 best-performing days would even turn a profit into a loss, resulting in a 32% loss. (See the chart below.)

*Source: Bloomberg, Sun Life Asset Management (data as of February 28, 2025, calculated in local currency).

Therefore, during volatile market conditions, investors should remain calm. As the MPF is a long-term investment spanning decades, employees should avoid making hasty investment decisions based on short-term market fluctuations. Doing so could lead to market timing risks and potentially result in significant losses.

Disclaimer: The information, data, and documents provided on this website are for general reference purposes only and should be used as self-help tools. Investment involves risks, and unit prices may fluctuate. Past performance figures shown are not indicative of future performance. BestServe Financial Limited and its content providers are not responsible for any loss or damage caused by reliance on any information or advice made in this website.